kansas sales tax exempt form agriculture

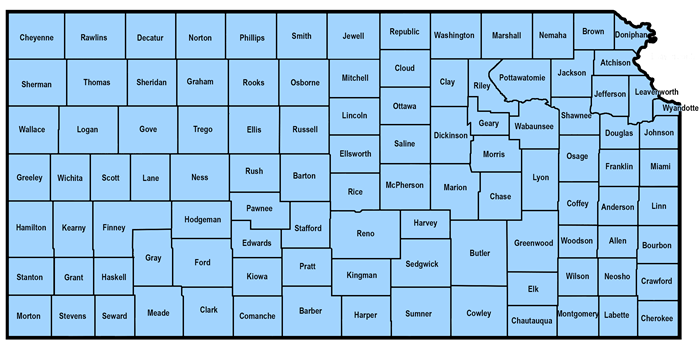

How to use sales tax exemption certificates in Kansas. Most large animal small animal and brand applications can be submitted online through Kelly Solutions by clicking here.

Form St 28f Download Fillable Pdf Or Fill Online Agricultural Exemption Certificate Kansas Templateroller

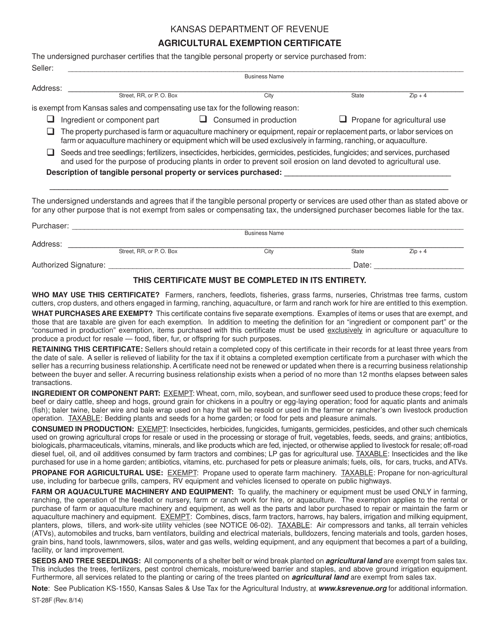

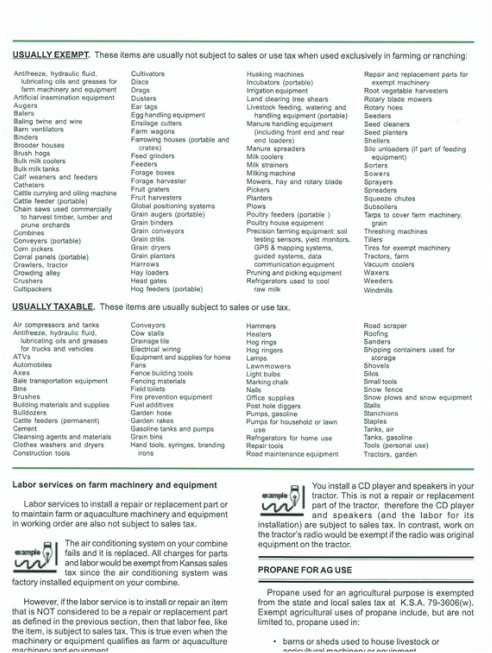

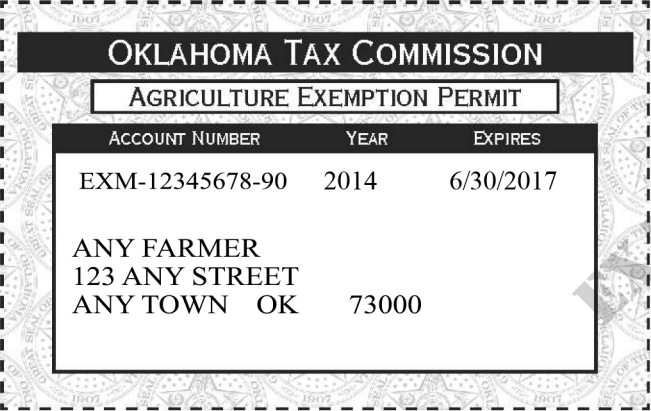

Farmers per se are not exempt from Kansas sales or use tax.

. Online Applications and Renewals. Including grain bins silos and corn cribs were exempted from sales tax. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making.

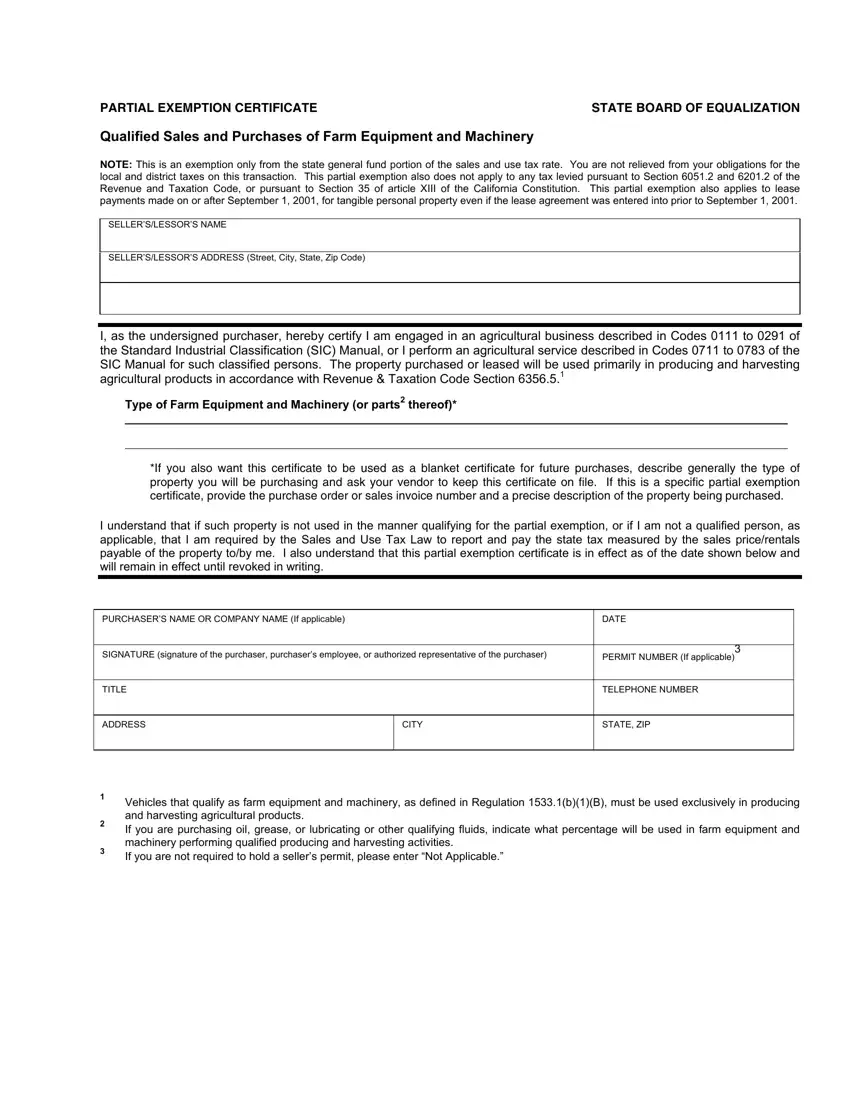

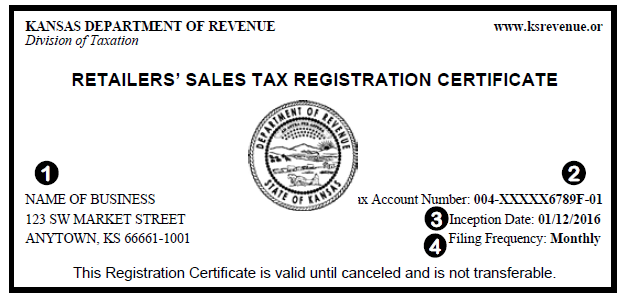

KANSAS DEPARTMENT OF REVENUE AGRICULTURAL EXEMPTION CERTIFICATE The undersigned purchaser certifies that the tangible personal property or services purchased. These are the tax exemptions for. Kansas Sales Tax Exempt Form Taxes Exemption Varieties can come in a range of types.

This includes the trees fertilizers pest control chemicals moistureweed barrier and staples and above ground irrigation equipment. For corporations whose business income is solely within state boundaries the tax is 4 of net income. Are exempt from sales tax.

The Kansas sales tax rate is a combination of the state. KS-1510 Kansas Sales Tax and. Rate of 65 plus any.

Complete the Streamlined Sales Tax Agriculture Exemption Certificate before making your agricultural related purchases with KanEquip. Included in this are the Contractors Exemption Certification Service in Fight MIT and. Payments may be made via credit.

Is exempt from Kansas sales and compensating use tax for the following reason check one box. Dodge City KS 1451 S 2nd. Compensating Use Tax from our website.

PART C - WORK-SITE UTILITY VEHICLE Confirm that the purchased vehicle has all the following specifications. In addition net income in excess of 50000 is subject to a 3. Devoted for agricultural use is subject to Kansas sales tax.

For tax exemption status. However there are four sales and use tax exemptions specifically for agribusiness.

The Tax Break For Kansas Farmers That Few Know About Kcur 89 3 Npr In Kansas City

Is My Purchase Taxable Stillwell Sales Llc

The Tax Break For Kansas Farmers That Few Know About Kcur 89 3 Npr In Kansas City

Partial Exemption Certificate Farm Pdf Form Formspal

Amazon Certificates Required State For Exemption Tax Refund User Guide Manuals

Form St 16 Fillable Retailers Sales Tax Return

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Kansas Department Of Revenue Pub Ks 1510 Sales Tax And Compensating Use Tax

Ks Dor Ks 1520 2015 2022 Fill Out Tax Template Online Us Legal Forms

Dimensions Of Sales Tax Exemption Policy The Arizona Model

Kansas Tax Exempt Form Pdf Fill Online Printable Fillable Blank Pdffiller

Download Business Forms Premier1supplies

Get And Sign Who Fills Out Kansas Department Of Revenue For Pr 74a Form 2005 2022

Form Pec Entities Fillable Sales And Use Tax Refund Application For Use By Project Exemption Certificate

.jpg)